All Categories

Featured

Table of Contents

- – All-In-One Accredited Investor Investment Oppo...

- – Renowned Accredited Investor Real Estate Inves...

- – Optimized Accredited Investor Crowdfunding Op...

- – Investment Platforms For Accredited Investors

- – Professional Accredited Investor Opportunities

- – Expert Accredited Investor Syndication Deals...

- – First-Class Exclusive Deals For Accredited I...

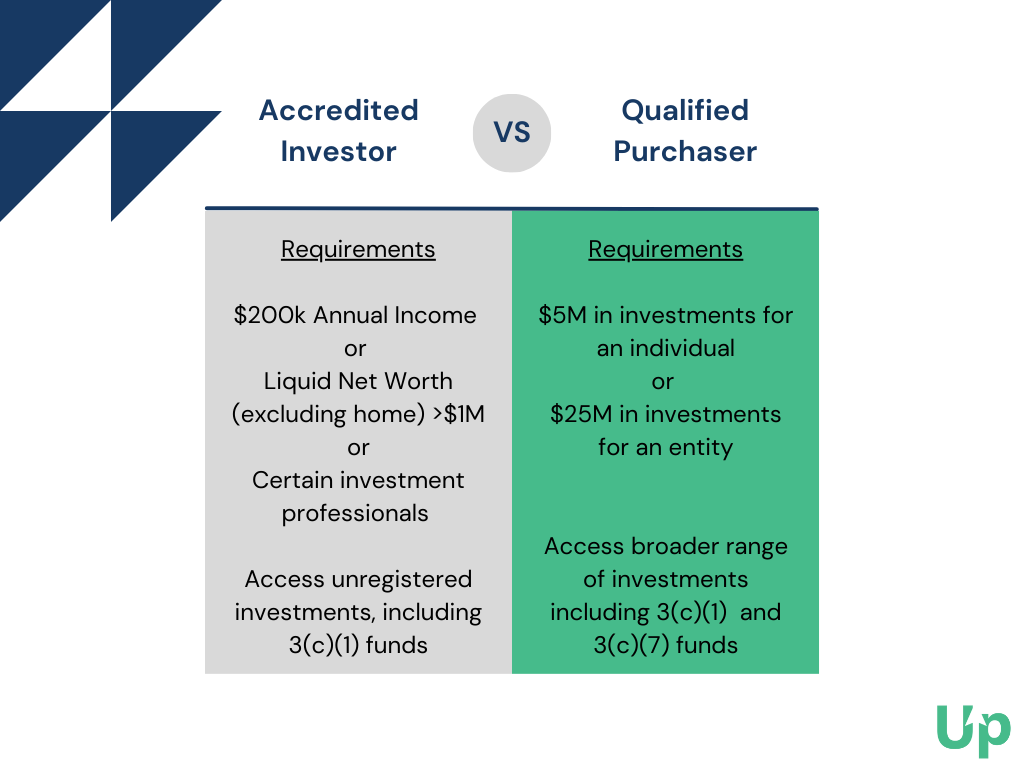

The laws for accredited financiers vary amongst jurisdictions. In the U.S, the meaning of a recognized financier is put forth by the SEC in Regulation 501 of Law D. To be a recognized financier, an individual must have an annual income exceeding $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of gaining the very same or a higher earnings in the present year.

An accredited financier ought to have a total assets surpassing $1 million, either separately or collectively with a partner. This amount can not consist of a main home. The SEC likewise takes into consideration applicants to be recognized capitalists if they are basic partners, executive officers, or directors of a firm that is issuing unregistered protections.

All-In-One Accredited Investor Investment Opportunities

If an entity consists of equity proprietors that are certified investors, the entity itself is an accredited financier. Nevertheless, an organization can not be developed with the single objective of purchasing particular protections - investment platforms for accredited investors. An individual can certify as an approved investor by showing adequate education and learning or task experience in the monetary sector

People who wish to be recognized investors don't apply to the SEC for the classification. Rather, it is the responsibility of the company providing an exclusive positioning to make certain that all of those approached are approved financiers. People or events that wish to be certified financiers can approach the company of the non listed securities.

Mean there is a private whose earnings was $150,000 for the last 3 years. They reported a key home value of $1 million (with a mortgage of $200,000), a vehicle worth $100,000 (with an impressive lending of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This person's web worth is specifically $1 million. Given that they fulfill the internet worth need, they certify to be an accredited capitalist.

Renowned Accredited Investor Real Estate Investment Networks

There are a couple of much less usual qualifications, such as managing a trust with even more than $5 million in properties. Under government securities regulations, just those that are certified investors may take part in certain protections offerings. These may consist of shares in exclusive positionings, structured items, and personal equity or hedge funds, to name a few.

The regulators wish to be certain that individuals in these highly risky and complicated investments can fend for themselves and evaluate the risks in the absence of federal government defense. The accredited financier guidelines are designed to protect possible capitalists with limited economic understanding from adventures and losses they may be sick outfitted to hold up against.

Approved capitalists meet qualifications and specialist requirements to accessibility exclusive financial investment chances. Designated by the U.S. Securities and Exchange Payment (SEC), they gain entrance to high-return options such as hedge funds, equity capital, and private equity. These investments bypass full SEC registration yet bring higher risks. Certified investors have to fulfill income and net well worth needs, unlike non-accredited people, and can invest without constraints.

Optimized Accredited Investor Crowdfunding Opportunities for Accredited Investment Results

Some crucial modifications made in 2020 by the SEC include:. This adjustment acknowledges that these entity kinds are usually utilized for making investments.

This change make up the results of inflation gradually. These modifications broaden the recognized financier swimming pool by around 64 million Americans. This larger accessibility supplies extra chances for investors, yet also increases potential risks as less monetarily sophisticated, investors can participate. Companies using private offerings may gain from a larger pool of prospective financiers.

These investment choices are unique to recognized financiers and organizations that certify as an approved, per SEC guidelines. This provides accredited financiers the possibility to invest in emerging firms at a phase before they take into consideration going public.

Investment Platforms For Accredited Investors

They are deemed investments and are easily accessible only, to certified clients. Along with recognized business, qualified investors can pick to buy start-ups and promising ventures. This offers them income tax return and the possibility to get in at an earlier stage and potentially gain incentives if the firm succeeds.

Nonetheless, for investors available to the risks entailed, backing start-ups can result in gains. A lot of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage startups supported by accredited angel capitalists. Innovative capitalists have the opportunity to discover financial investment choices that may generate much more earnings than what public markets offer

Professional Accredited Investor Opportunities

Although returns are not ensured, diversification and profile improvement choices are expanded for financiers. By expanding their profiles through these increased financial investment opportunities recognized capitalists can enhance their techniques and potentially attain exceptional long-term returns with correct threat administration. Skilled investors typically come across financial investment options that might not be conveniently offered to the general capitalist.

Financial investment options and protections supplied to accredited financiers generally entail higher risks. For instance, exclusive equity, financial backing and hedge funds often concentrate on spending in properties that lug risk yet can be sold off conveniently for the possibility of better returns on those risky financial investments. Investigating before investing is crucial these in situations.

Secure periods stop financiers from taking out funds for even more months and years on end. There is likewise much less transparency and governing oversight of exclusive funds contrasted to public markets. Capitalists may battle to accurately value exclusive properties. When taking care of threats certified financiers need to evaluate any kind of private investments and the fund managers involved.

Expert Accredited Investor Syndication Deals with Accredited Investor Support

This adjustment may prolong recognized investor status to a series of people. Updating the revenue and property standards for inflation to ensure they show modifications as time proceeds. The current thresholds have stayed fixed because 1982. Allowing companions in dedicated relationships to combine their sources for shared eligibility as certified capitalists.

Enabling people with certain expert qualifications, such as Collection 7 or CFA, to qualify as recognized investors. This would certainly recognize monetary sophistication. Producing additional needs such as proof of economic proficiency or effectively finishing a certified financier exam. This might guarantee investors understand the threats. Restricting or eliminating the main house from the web well worth calculation to minimize potentially inflated assessments of riches.

On the various other hand, it can likewise lead to skilled capitalists presuming too much threats that may not be appropriate for them. So, safeguards may be needed. Existing certified financiers may deal with enhanced competition for the very best financial investment possibilities if the pool grows. Firms elevating funds might take advantage of an increased accredited financier base to draw from.

First-Class Exclusive Deals For Accredited Investors

Those that are presently thought about accredited capitalists have to remain upgraded on any changes to the criteria and regulations. Their qualification could be subject to modifications in the future. To maintain their status as accredited investors under a modified interpretation changes might be necessary in wealth monitoring techniques. Services seeking accredited capitalists must stay attentive about these updates to ensure they are drawing in the ideal audience of financiers.

Table of Contents

- – All-In-One Accredited Investor Investment Oppo...

- – Renowned Accredited Investor Real Estate Inves...

- – Optimized Accredited Investor Crowdfunding Op...

- – Investment Platforms For Accredited Investors

- – Professional Accredited Investor Opportunities

- – Expert Accredited Investor Syndication Deals...

- – First-Class Exclusive Deals For Accredited I...

Latest Posts

How To Tax Lien Investing

How To Buy Tax Sale Property

Delinquent Tax Homes For Sale

More

Latest Posts

How To Tax Lien Investing

How To Buy Tax Sale Property

Delinquent Tax Homes For Sale